About this site

Fear, greed, panic, euphoria—these feelings drive traders’ decisions long before logic has time to kick in. A study of 100,000 active traders showed: only 12% make data-driven decisions, while 68% trade purely on emotions. Traders lose $2.8 trillion annually due to emotional decisions—this isn’t a lack of information, but a psychology problem.

RAA Vision works with the emotional core of trading. The platform doesn’t try to predict the next price move—it helps you understand why that move is happening and how your behavior reacts to it. The system processes 5+ billion posts from social media, tracks 60,000+ influencers, and serves 1.5 million users through AI with 87% accuracy in recognizing emotional states.

Architecture: Six Layers of Behavioral Analysis

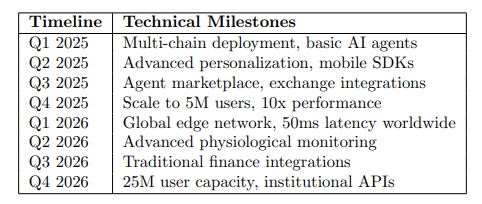

The system is built on multi-chain infrastructure and processes massive data arrays in real-time:

• Blockchain Layer: Smart contracts on ETH, BNB, BASE, Solana—cross-chain synchronization via merkle proofs to ensure data consistency

• Data Layer: 5+ billion posts from social media, data from 50+ exchanges, funding rates, on-chain activity, tracking 60K+ influencers in real-time

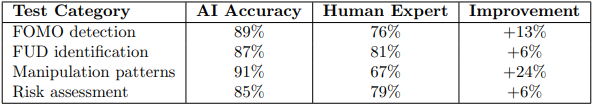

• AI Engine: 15 million training signals, recognition of 12 emotional states (FOMO 89%, FUD 87%, manipulation 91%), transformer architecture with custom embeddings

• Agent Playground: No-code agent builder, agent tokenization, ability to create and monetize your own strategies

• Marketplace: Agent templates with validation system, API for external platform integration, 85/15 revenue sharing for creators

• Interface Layer: INSIDERAA App (500K+ MAU), RAAdar (personal AI companion), RAAgents, Telegram Mini-App—multi-platform access

The platform doesn’t analyze markets—it analyzes and improves the traders themselves.

How AI Recognizes Trader Emotions

RAA Vision uses an ensemble of specialized AI models to identify behavioral patterns at the individual level:

Social Sentiment NLP: Processes 100,000+ posts per second from Twitter, Telegram, Discord, Reddit through transformer models with custom behavioral embeddings

Behavioral Pattern Recognition: LSTM networks analyze individual user triggers—what specifically launches their emotional reactions, at what time of day they make their best decisions

Market Structure Analysis: Detects anomalous market conditions that typically cause emotional reactions—sharp volatility spikes, coordinated buys/sells, extreme funding rates

Physiological Monitoring: Integration with wearable devices (Apple Watch, Fitbit, Oura Ring) to determine stress levels through HRV, skin conductance, sleep quality.

The system processes data and generates alerts in less than 100ms—fast enough to prevent an impulsive decision before it’s executed.

Personal AI Agents: Your Trading Psychologist

Each user receives a personal AI agent that learns from their specific behavioral patterns. The agent identifies triggers (what launches emotions), recognizes success patterns (when the best decisions are made), models dynamic risk tolerance depending on psychological state.

The system works through escalation protocols: from soft notifications to temporary trading blocks when high risk of emotional decision is detected. Users who completed behavioral training show 34% improvement in trading results.

Tokenomics: Sustainable Economy Without Inflation

Total supply: 1 billion $RAA tokens. Fixed supply without inflation creates scarcity:

• Presale + Public Sale: 20% with 12-month linear vesting

• Staking + Liquidity: 20% through dynamic DAO model with 25-30% yield from actual protocol revenue, no token printing[raa]

• Ecosystem Rewards: 20% for quests, agents, educational activities

• Team & Advisors: 15% with 12-month cliff and 24-month vesting

• Validators: 10% with progressive distribution

• Strategic Partners: 10% with 6-month lock and 18-month vesting

60% of tokens go directly to users—most projects allocate 20-30%.The token is used for access to AI agents, alpha signal subscriptions, staking, running nodes, DAO voting, and paying for protocol actions.

Token Utility: From Education to Governance

With $RAA, users get access to a multi-level system:

• Payment for AI agents and subscriptions with 20-40% discount compared to fiat payments

• Access to alpha signals and API for integration (staking 10K+ RAA unlocks basic features)

• Copying or creating custom agents in the marketplace (requires 500K+ RAA stake for creation)

• Staking and running validator nodes with 25-40% yield from actual revenue[raa]

• Voting and participation in DAO protocol governance (vote weight from 1x to 25x depending on stake)

• Payment of fees for actions within the ecosystem

Top agents can issue their own tokens ($XRAA) as gas tokens or access tokens.

INSIDERAA Academy: Free Risk Management Training

The Academy operates as a free app with 500,000+ monthly active users and 89% course completion (versus 15% industry standard). Users progress through a 30-level system: from basic recognition of cognitive biases to advanced psychological resilience.

The protocol rewards learning with tokens: 50-200 RAA for courses, 25 RAA for 7-day consistency, 15 RAA for avoiding FOMO trades (AI-verified), 100 RAA for beating personal record with risk consideration. This creates a network effect: better traders → more revenue → better technology → even better traders.

Team and Infrastructure

15+ engineers, traders, and analysts with experience in high-load crypto products. Proprietary AI infrastructure: Llama 3.3, DeepSeek, GPT-4o. Using ClickHouse, vector databases, reinforcement learning for model training.

The system processes 1M+ posts per hour, 100K+ transactions per minute, 10K+ market data feeds per second. Target performance by end of 2026: 1M inference/sec for ML models, 10TB data per day.

Why This Matters Now

The AI market in Web3 is just forming—but RAA Vision is already here, with ready architecture, audience, and products before listing. Behavioral analytics will soon become the new norm for protocols, traders, and funds.

Research shows: 95% of day traders lose money not because of poor analysis, but because of emotions. Emotions drive the market, but no one provides tools for control. RAA Vision helps you see market movements more clearly—through experience, through technology, through understanding yourself.

→ raa.vision