Anchoring to the Entry Price, Controlling Decisions

Traders like to see themselves as rational: there’s a chart, there are levels, there’s risk management. But in practice, one number can take control—the entry price. In behavioral finance this is called anchoring: the tendency to rely excessively on the first available information when making decisions.

What an “Anchor” Means in a Market Context

An anchor is not just a “memory of a price.” It’s a reference point around which the brain builds its evaluation of what’s happening:

- “It’ll come back to my entry — then I’ll decide,”

- “I was right, the market is just unstable,”

- “Just a bit more and I’ll be at breakeven.”

The problem is the market is not obligated to “respect” your entry. It’s your personal point of reference, not an objective parameter of the current market structure.

Why Anchoring So Often Breaks Risk Management

Anchoring is especially toxic in two situations:

- A losing position

Instead of assessing whether the scenario has broken, the trader evaluates only the distance to the “saving” entry price. This shifts focus from process to hope and often leads to holding longer than the plan/mental endurance allows. - A winning position

Paradoxically, an anchor can also be an “ideal” take-profit: the trader sees +X, wants to take exactly X, and closes too early because the number has already become the goal.

In both cases, the decision is determined not by the market, but by a number in the trader’s head.

How to Tell Analysis From an Anchor: A Simple Test

If the argument sounds like “because I entered at ___,” that’s suspicious.

Analysis should sound like: “because right now the structure/volatility/liquidity has changed in this way, and the scenario is confirmed/broken.”

In other words, in good reasoning the key word is “now,” not “then.”

Practice: Reframing the Decision

A useful shift in focus (you can write it straight into a checklist):

- Instead of: “Will it return to my entry?”

Ask: “Where is the invalidation point of my scenario?” - Instead of: “It hurts to close a loss.”

Ask: “If I didn’t have a position, would I enter now?” - Instead of: “I’ll wait just a bit more.”

Ask: “What signal must appear for waiting to be justified?”

These questions force the brain to detach from the first number and return to current data.

Why This Matters in 2026

The market has become more fragmented: short impulses, sharp reversals, regime shifts. In such conditions, anchoring gets more expensive, because a “return to entry” may not happen for weeks, while time and capital are limited.

Anchoring is not a moral “flaw.” It is a standard cognitive setting of the human mind—very hard for anyone to break. But in trading, default settings often lose. The winner is the one who builds procedures that bring the decision back to the “here and now.”

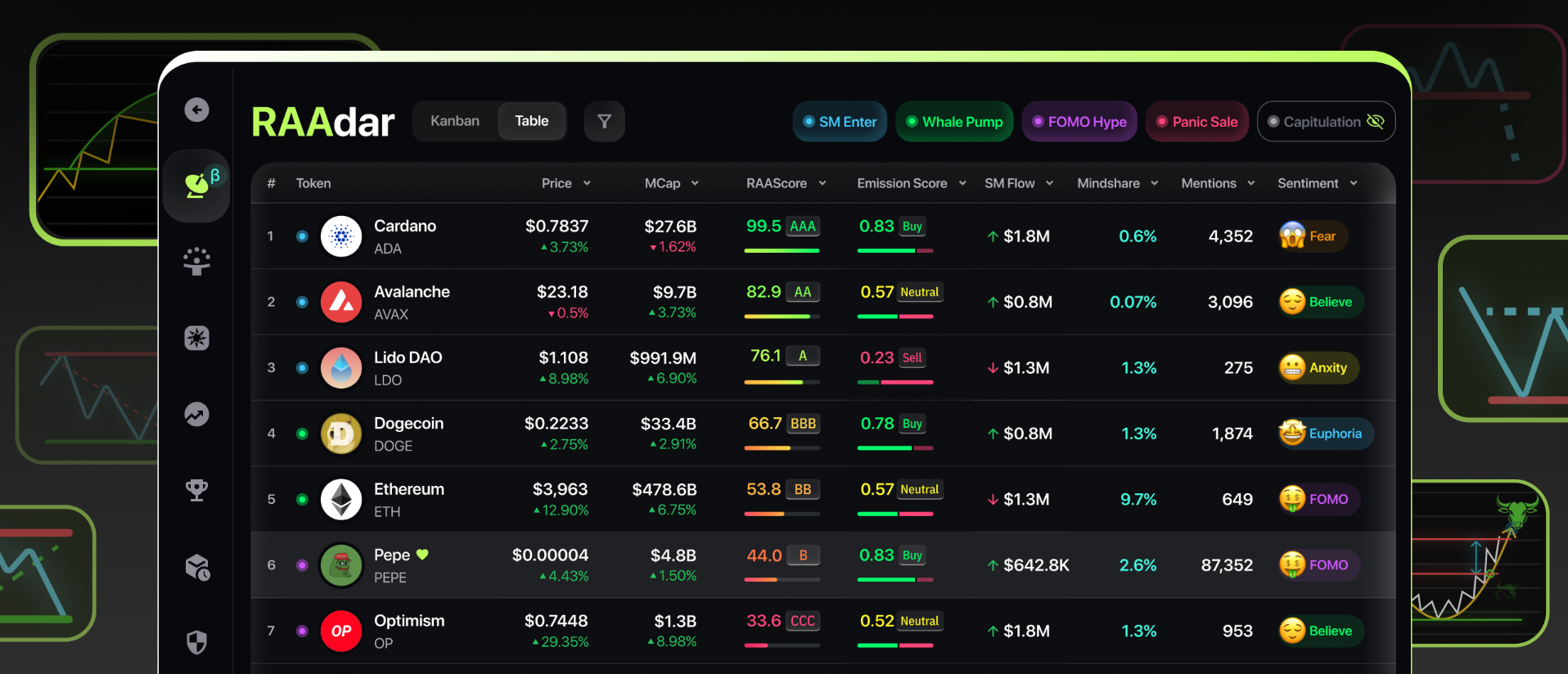

→ raa.vision | Whitepaper