The Neurobiology of Volatility Becomes the Trader's Dopamine

A trader's brain during high volatility operates in a special mode. Sharp price movements trigger neural mechanisms that block rational thinking:

- The prefrontal cortex (the zone of balanced decisions) is suppressed by emotional centers,

- The release of neurotransmitters occurs not from profit, but from the very sensation of movement in the market,

- The brain begins to perceive volatility as a reward, rather than as a condition for working according to strategy,

- A neural loop is formed: the harder the market swings, the more you want to open positions.

The trader stops analyzing probabilities and managing risks — they simply crave the next strong market movement.

Strategy takes a back seat, while the hunt for emotions from trading takes the front.

How to Recognize Patterns of Impulsivity

Symptoms manifest at the behavioral level and are easily tracked through trade history:

- A sharp increase in entry frequency during periods of high volatility, even if there is no setup according to strategy,

- Ignoring capital management rules: increasing position sizes, absence of stops, premature profit-taking,

- Impulsive entries at movement peaks, when rational assessment says "stop," but emotions scream "now or never",

- Feelings of boredom and irritation during periods of low volatility, even when the market provides quality trading opportunities.

In this state, the trader trades not for earnings, but to receive emotional stimulation. The brain forms a stable connection: volatility = excitement = reward. This destroys discipline and turns the market from a working tool into a source of emotions.

Why This Works Against the Trader

The neural reaction to volatility creates a closed loop. The trader begins making decisions on autopilot, guided not by analysis, but by impulse. Rational thinking shuts down precisely in those moments when it's needed most — in conditions of high risk and unpredictability.

Large players know about these patterns and exploit them. Sharp movements, false breakouts, aggressive stop hunts — all of this exploits the emotional vulnerability of the crowd. While the masses chase movement on emotions, professionals work according to plan and capture liquidity in moments of maximum chaos.

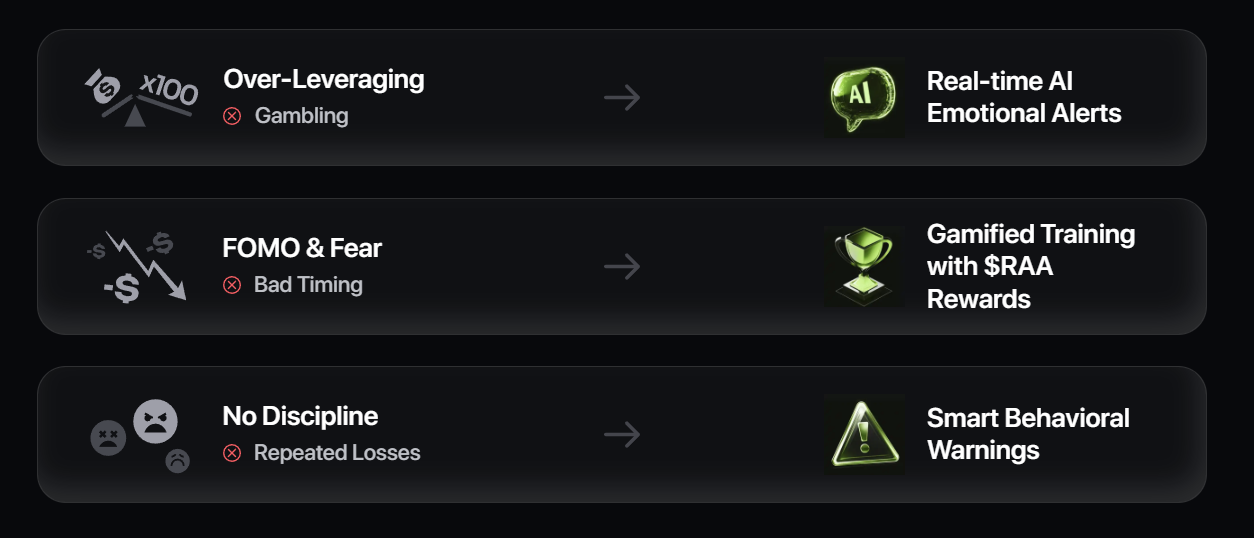

RAA.Vision: An Impulsivity Detector at the Action Level

RAA.Vision doesn't try to predict the market — the platform analyzes the trader's own behavior. The system tracks patterns that reveal emotional decisions:

moments when entry occurs outside of strategy, at the peak of volatility,

series of trades where position size and risk management are violated,

periods when trading frequency sharply increases without objective reasons.

The platform works like a mirror: it shows the trader their blind spots — those moments when a decision is made not by analysis, but by emotional reaction to market movement. This helps break the cycle of impulsivity through awareness of one's own behavior.

The goal of RAA.Vision is not to eliminate emotions (that's impossible), but to provide a tool for recognizing them in real time. When the trader sees the pattern of "chasing movement" at the data level, they get a chance to stop, return to strategy, and make a decision consciously, not on autopilot.